Bitcoins recent run up has led people wondering where they can start their bitcoin journey. This is a collection of resources and the train of thought that guided me through the bitcoin rabbit hole.

The bitcoin journey begins by trying to understand why this imaginary money could be useful. There have been multiple visions debated. Nic Carter (@nic__carter) & Hasufly (@hasufl) explain the different value props bitcoin has commandeered.

https://medium.com/@nic__carter/visions-of-bitcoin-4b7b7cbcd24c

It becomes clear that the digital gold narrative has gained the most steam. To test the narrative, bitcoin must be compared gold. Vijay Boyapati’s (@real_vijay) bitcoin bull case is a timeless piece. The essay dissects core characteristics of money and applies them to bitcoin.

https://vijayboyapati.medium.com/the-bullish-case-for-bitcoin-6ecc8bdecc1

Matt Huang (@matthuang) lays out an identical digital gold thesis. He also refutes a few bearish bitcoin arguments (i.e. bitcoin is a bubble) which are incredibly important to internalize. This thesis paper is an absolute must read.

https://www.matthuang.com/bitcoin_for_the_open_minded_skeptic

Once the comparison for bitcoin as digital gold is understood unpacking why we need a store of value now more than ever is explained by an all time great macro investor, Paul Tudor Jones.

Not only are smaller firms piling into the store of value narrative, large investment shops like Fidelity have agreed on this thesis.

Why do we need bitcoin if we experience minimal inflation in the US? Outside of my contention with CPI measures, there is a genuine need for stores of value in emerging countries that experience hyperinflation. I explain the emerging market adoption in a previous post. More specifically, this hackernoon article is what solidified the potential use case for crypto in suppressed emerging countries.

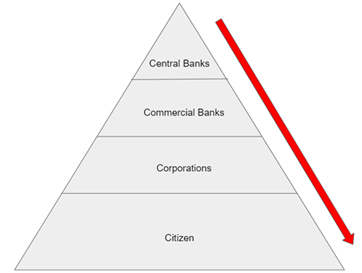

Inflation hurts everyone in the monetary ecosystem, but it especially hurts those in lower social classes. Whoever is issuing the currency sees the highest value of it (i.e. government). For inflation to be realized within an economy there is a trickle-down value effect. Central banks see the highest value of the dollar printed, while the consumer who sees it last, will witness the least value in the currency. It is something I call the Currency Value Deterioration Pyramid. This is also academically called the Cantillon Effect.

This begs the question of how to launch a fair money? This was a major debate when cryptocurrencies were launching ICO’s (initial coin offerings) similar to IPO’s. Although a bit in depth on altcoins, Hasu and Arjun Balaji (@arjunblj) dive into the fairest way to launch a currency. The TLDR can be summarized by this quote:

the concept of “fairness” is ultimately subjective and a “perfectly fair” launch a pipe dream

https://uncommoncore.co/grin-and-the-mythical-fair-launch/

Bitcoin is the fairest launched currency, even compared to fiat. Unlike the value deterioration pyramid that citizens suffer from, bitcoin adoption has been led by the people, not central governments.

Bitcoin is becoming the freedom currency. Skeptics will say early adopters are unduly befitting from late buyers. Although buying bitcoin pre-2016 was incredibly risky. People have been working on perfecting a cryptocurrency for decades and still are. Whether bitcoin was going to become the clear winner was not certain. The adoption of bitcoin is flipped from that of a nation-state currency led by early adopters to retail investors to institutions. Maybe the last leg will be led by central banks? The US government is known to be holding the largest reserve of gold.

Outside of adoption cycles, bitcoin has an immaculate social layer that allows everyone running a node to participate in defining network rules. Anybody can vote on changes by simply running a node. On the other hand, citizens have no say for fiat currency changes. We are subject to whatever our policy makers feel is correct, which has become printing money at will. The social contract is an opportunity for bitcoin holders to have their voice heard. It is incredibly important feature of bitcoin.

https://uncommoncore.co/unpacking-bitcoins-social-contract/

My concluding thesis: Bitcoin will become the vehicle of seamless global payments, wealth protection, and liberation splintering from current nation-state monetary failures.