Time Scarcity

The ultimate resource of this world is time. The time you spend on this earth is limited. The average life expectancy is 78 years. By the age of 22, we are thrown to corporate where we sell our time from 9am-5pm everyday. The average citizen works and saves every penny in the hopes to be financially independent. We work hard, spend time away from those we love, pay taxes, yet the government steals the value of our time through inflation. Each hour you spend working becomes worth less in the future. Your time is being stolen by the government . By preserving your time in bitcoin, you can store it generation over generation with provably no deterioration.

Units in Hours

The average American spends 40 hours a week working. You do this, your parents do this, your grandparents did this. As humans in a capitalistic world we exchange our labor for money, an asset that carries universal perceived value. We can trade the money for goods and services within the economy. Let’s assume you work at a rate of $50/hour. Suppose you decide to take a girl out on a fancy date, you spend $150. You have effectively traded 3 hours of your labor. Every purchase can be seen as a denomination of your time. Groceries cost 2 hours, rent costs 30 hours, gas costs 1 hour etc. you get my drift.

In reality, we haven’t shifted far from the barter system. All we have done is added a medium exchange to transfer value more effectively between people. The dollar is a liquid asset that we use to exchange value. I give you an hour of my time, you pay me $50 instead of giving me cattle or bar of gold. We are constantly exchanging our time for money. Time is money. Money is Time.

Proportionally, the value you create within the economy at a specific moment should be preserved regardless of the change in inflation. In the event that you and your grandfather are providing a similar service to the economy, why should your grandfather’s hours be worth less than yours based on the year worked?

Time Theft

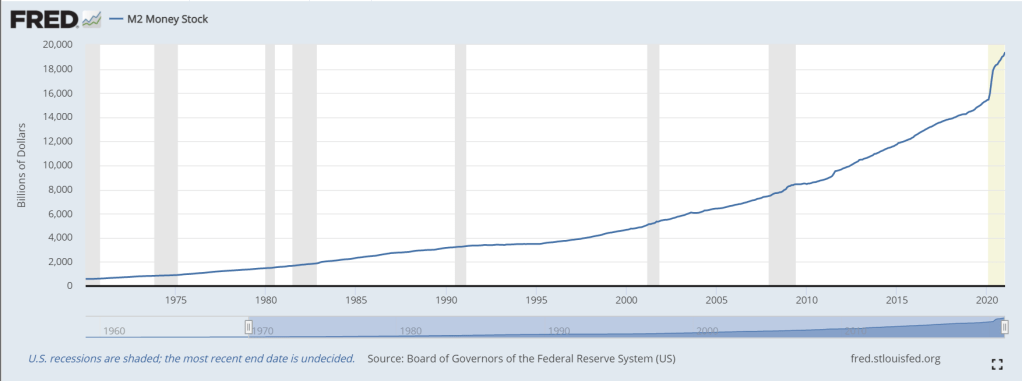

Everything we trade for is denominated in dollars. Assuming the value of goods and services remain relatively unchanged, your raw statistic on inflation should be the money supply. Money is the measuring tool of value. M2 measures the amount of total money in the economy. This includes cash, demand deposits, checks, and money market funds. Since 1970, M2 has seen a 33x increase.

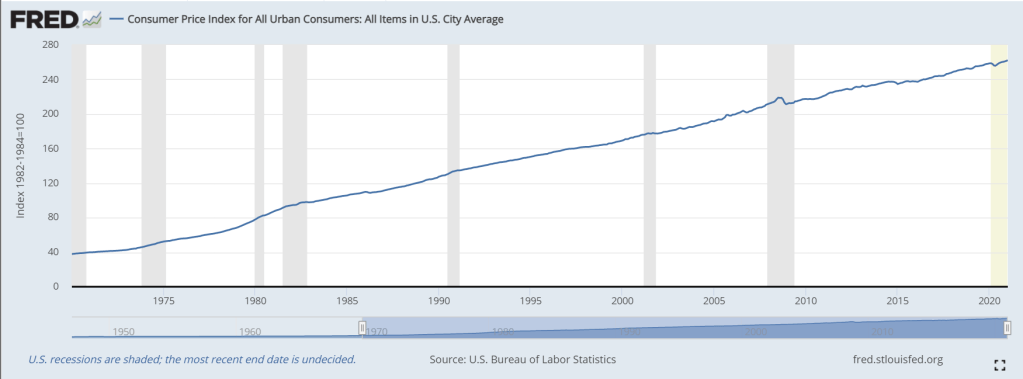

Although, M2 is not used as the inflation metric by the Federal Reserve. Instead, the Federal Reserve uses the Consumer Price Index (CPI). The CPI is comprised of an ever-changing basket of goods that includes items the Fed believes are essential to living. The CPI will include items like rent, food, energy, tv’s, refrigerators, phones etc. As you can see below, the CPI has only 7x since 1970.

The CPI is the go to metric for the Fed, yet there are many essential assets that have outpaced the CPI’s inflation. The basket of goods is not outright defined but rather decided arbitrarily. For this reason, people contest the legitimacy of the CPI. For example, since 1980 the CPI has lagged behind the rising rates of college tuition.

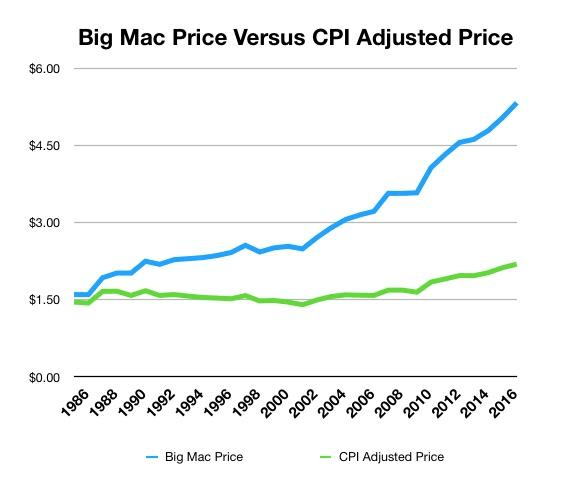

Synonymously, the Big Mac Index which has gained popularity as an informal measure of inflation, has also outpaced the CPI.

Whether or not you believe the CPI is a true inflation metric, a 7x inflation since 1970 is nonetheless concerning. Not only is a 7x concerning, other hard assets are witnessing faster inflation than the CPI.

Taking Your Time Back

Bitcoin is the asset to take your time back. As your friends run on the fiat treadmill for 40 years to save enough money to retire, you can simply store your time in bitcoin. A fixed monetary policy allows holders to plan for future inflation. Currently, bitcoin is dubbed as a “speculative asset”, yet the only thing we are speculating is the monetary policy of the US dollar. I will pass my wealth to my grandkids, unhindered of what the Fed decides to do tomorrow. Why risk exposing myself to USD’s whimsical value swings? The thing I am sure is that there will only be 21 million bitcoin. This will lead bitcoin to be used as a wealth transfer across time