What Is MEV?

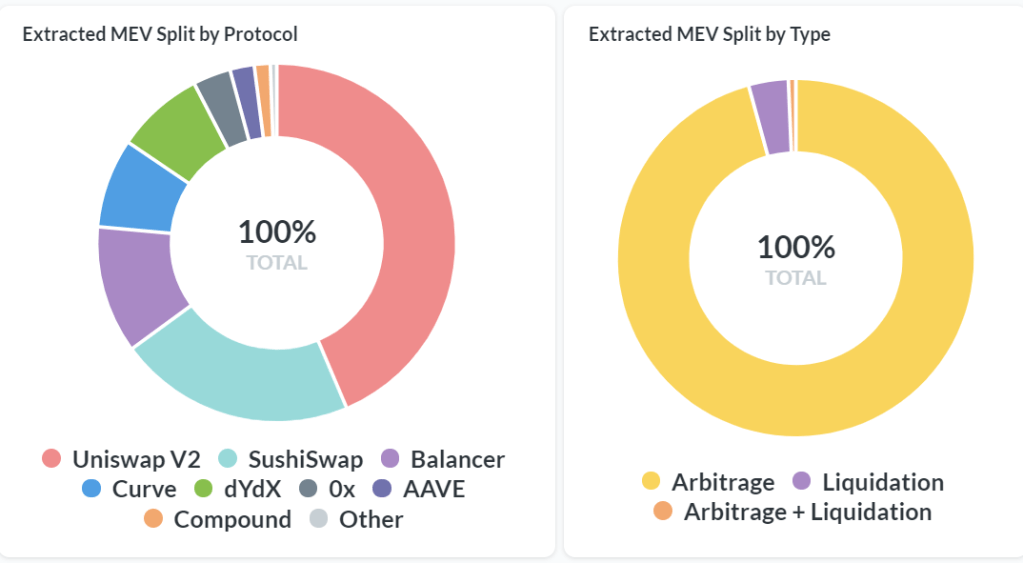

Miner Extractable Value (MEV) is value that miners/validators make by censoring users, reordering transactions, or implementing their transactions before others. Miners are not the only ones searching for MEV. MEV bots, run by traders bid up gas fees in an attempt to prioritize there transaction to extract value. 97% of the time MEV is an arbitrage opportunity. The arbitrage arises from an asset that is mispriced between two decentralized exchanges (DEX). During periods of high volatility, miners can take advantage of liquidations of collateralized loans that fail to meet Loan-to-Value requirements. Algorithmic protocols require liquidity during volatile phases and will sell at prices that differ from the spot price.

The value is extracted by miners probing transactions in the mempool. The miner reorders transactions or inserts their transaction while refusing to include the creator’s transaction. This threatens the security and decentralization of blockchains because it destroys the neutrality of transactions. Miners not engaging in first-price auctions will inhibit all smart contract decentralized platforms moving forward. On Ethereum, these auctions are referred to as Private Gas Auctions (PGA). Miners simply reorder transactions to extract MEV. On the other hand, trading bots race to extract the MEV, which turns into a gas bidding war. The PGA’s begin to rise not only for the bots bidding against each other, but anyone trying to submit a transaction on-chain. This can be harmful to all users, especially those not trying to submit priority transactions. The bidding wars make everyone on-chain pay higher gas fees. It also fills the mempool with repeated/invalid transactions.

Why is MEV happening?

Traditionally, Proof of Work (PoW) chains are First-Price auctions. This implies that miners will select transactions to include in their block based on which transactions have the highest associated transaction fee. This worked seamlessly on bitcoin because the transactions were fungible. Each transaction requires approximately the same amount of computation. A simple wallet-to-wallet transfer represents each bitcoin transaction. This leads miners to the First-Price ordering of transactions. They choose the transactions with the highest transaction fee. Below is a depiction of how to think of the bitcoin state of chain.

Although, smart contracts on blockchains introduce dimensionality to transactions. Ethereum transactions are have memory, or associated code included in the smart contracts. Unlike Bitcoin, Ethereum has a token along with the smart contract functionality. Transactions on Ethereum are all unique, which creates opportunities to exploit alpha (i.e. MEV). Below is a depiction of Ethereum’s state of chain.

Ethereum consists of two types of transactions:

- Inclusion Transactions – Transactions that are simple transfers. These transactions would include transfers of NFT’s or simply sending ETH address to address. Inclusion transactions are not subject to timing. The transaction is unique in that manner, and can not be exploited. Inclusion transactions offer little to no MEV.

- Priority Transactions – These transactions are time-sensitive. Prices of currencies are constantly changing, which means to hit limit/spot price, the transaction must be put through ASAP. Priority transactions are usually DEX exchanges. Each DEX list thousands of currencies and multiple DEX’s exist. The open-source nature of crypto allows anyone to fork a DEX or a new currency at the click of the button. Sushiswap, a popular open-source DEX, is a fork of Uniswap. Coincidentally, the two most common places for MEV to be found. Thousands of exchanges can be created, unlike traditional finance exchanges. This leads to information silos across DEX’s and more arbitrage opportunities to be exploited. MEV is most commonly found on DEX exchanges, which are characterized as priority transactions.

MEV extraction is hurting priority transaction creators while also increasing the price of inclusion transactions. Transferring NFT’s or ETH from one wallet to another is becoming more expensive than it should because of miners reordering transactions and bots bidding higher to extract MEV.

MEV Outlook

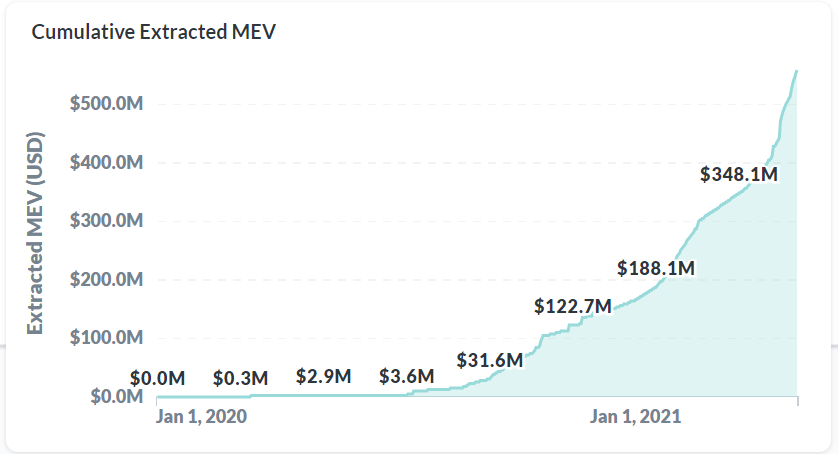

MEV is impossible to fix. MEV is everywhere because people prefer different outcomes on-chain. Each contract can create hidden value. As long as dimensionality exists on smart contract blockchains, there is no way to completely get rid of it. Therefore, it is a never-ending dark forest of MEV (a term coined by @danrobinson & @gakonst). Neither will we know how much MEV exists nor can we build a bot to extract it all.

Deeply rooted within the MEV discussions are whether it is fair for it to happen. Larger pools are running away with MEV because they have the resources to find and build algorithms to extract MEV. If miners are all attacking each other for MEV, the profitability for most miners drops off drastically. The misbalances create a superlinear function of value distribution across hash power being provided by miners. This in turn erodes the long-term value and security of smart contract platforms. In other words, MEV is driving direct upwards centralization pressure. That being said, the process of MEV brings robustness to the chain. Anyone can arbitrage transactions and in theory, makes the landscape of pricing more efficient.

What’s the move? Flashbots.

Flasbots is an open-source initiative that helps miners capture low-hanging MEV. The initiative decreases miner centralization and attempts to bring value back proportionally to the hash power provided by the miners to pools. Traditionally on PoW chains, miners that are providing hash power to a mining pool are paid out proportionally when a block is mined by the pool. For example, if you are staking 1% of the hash power in a pool, and the pool wins a block, you are paid out 1% of the earnings.

Instead of listing all the transactions in a PGA format (highest gas transactions first), Flashbots acts as a pass-through relayer connecting searchers to miners. Miners are shown bundles of transactions with the highest block subsidy + MEV rather than being shown transactions with the highest fees (PGA style). Miners are incentivized to opt into Flashbots because it increases the amount earned from mining. 80% of miners and about 58% of the hashpower have opted into Flashbots.

Discord members are posting MEV opportunities in the Flashbots channel to stop gas bidding wars before they begin. In the long run, the ETH community and miners are being incentivized to build a more open and usable smart contract platform for users.

ETH2 – Proof of Stake Implications

As ETH readies for the move to ETH2 the questions of MEV will turn to Validator Extractable Value (VEV).

VEV proposes the same essential questions as MEV. Although, as more people stake their ETH with larger validator pools (ie Coinbase, Binance, etc.), the ability to return better yields will hinge upon the specific validator mining pool’s ability to extract value. Presumably, the same effects of which miner centralization that is happening with MEV, will be mirrored in the PoS environment of ETH2. Validators that are extracting the most value will return the best yields, therefore incentivizing ETH holders to stake with them. This causes the same upwards centralization pressure that MEV creates. Flashbots currently works on ETH1 but does not apply to ETH2. This HackMD post from @Izzy- summarizes it best:

The current system will likely lead to a “race to the top” for staking pools, where it will make very little economic sense for most staking participants, and especially “retail stakers” (i.e. purchasers of staking derivatives), to participate in any pool apart from the largest few, which will be able to leverage economies of scale to offer substantial returns while keeping costs low

https://hackmd.io/@Izzy-/Eth2VevStaking

The ETH2 proposal does plan on having a validator threshold, meaning you can only stake anywhere from 15-30% of the entire network. This of course is to prevent centralization from one pool. Yes, I do believe major staking pools on ETH2 will beat out individual validators which does seem threatening to the decentralization of the ecosystem. That being said, decentralized staking pools are more intriguing than centralized ones. Validators are essentially racing to accrue the most ETH to run the most validators. Decentralized validator pools like Lido and Stakehound may even have advantages due to the ability to offer staking derivatives.

Conclusion

MEV is one of the most interesting dynamics. On one hand, miners doing exactly what they are incentivized to do, extract value while making pricing more efficient. On the other hand, this is creating negative externalities for users of Ethereum. MEV being tackled on ETH is further proof the Ethereum is by far and ahead away from every other smart contract platform. The discourse on MEV is incredibly healthy and positive even as we move to PoS. MEV is unavoidable but initiatives like Flashbots, EIP-1559, and L2 scaling like Optimism all bring hope to make extraction fairer.

Resources

https://hackmd.io/@Izzy-/Eth2VevStaking

https://pdaian.com/blog/mev-wat-do/

https://medium.com/@danrobinson/ethereum-is-a-dark-forest-ecc5f0505dff

https://www.youtube.com/watch?v=YfNeKo8FVjc&ab_channel=EpicenterPodcast